The AdC fines the SIBS Group for abusing its dominant position in accessing domestic payment schemes

Press Release 07/2024

March,19, 2024

The decision

The Portuguese Competition Authority (AdC) has fined the SIBS Group for abusing its dominant position in the payment services sector by requiring card issuers and acquirers seeking to access the SIBS Group's payment schemes to also contract its processing services.

Such tying practice is capable of restricting competition and innovation in the payment services sector, harming both competitors of the SIBS Group, which also provide processing services and ultimately merchants and consumers who were deprived of differentiated services.

According to the AdC's investigation, the SIBS Group abused its dominant position in the markets related to the group's payment schemes by conditioning access to these schemes upon the obligation to also contract its processing services.

This practice, which lasted for about three years, limited the entry and expansion of competing processors of the SIBS Group, which maintained market shares exceeding 90% in the markets for processing services throughout this period. The entities targeted by the AdC's decision are SIBS SGPS, SIBS FPS, SIBS MB, and SIBS Cartões.

The case was initiated ex officio by the AdC in November 2020, following a supervision and monitoring procedure of the financial sector, in particular an inquiry directed at a group of financial sector companies based on digital technologies (fintech). In January and February 2021, the AdC conducted dawn raids at the SIBS Group’s premises located in Lisbon. The AdC notified the draft infringement decision to the BdP, which provided relevant information. The AdC's decision does not colide with the BdP's powers of supervision

The practice

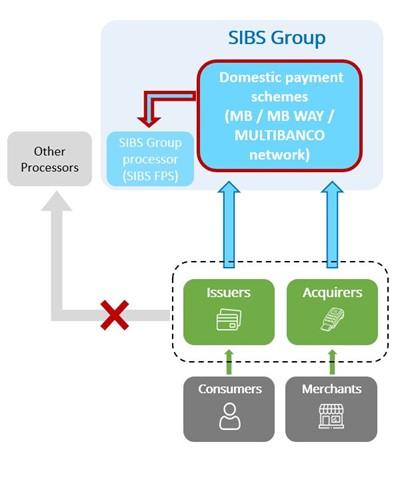

The SIBS Group is the entity responsible for domestic payment schemes, which are accessed by card issuers and acquirers.

Card acquirers are duly authorised payment service providers, namely banks, payment institutions or electronic money institutions, which act as intermediaries between commercial establishments and payment schemes, enabling merchants to accept a variety of payment methods, such as credit and debit cards.

Card issuers are duly authorised payment service providers, which offer payment cards under one (or more) payment scheme(s) to their customers (consumers).

The AdC’s investigation revealed that during the infringement period, card issuers and acquirers seeking to access the SIBS Group’s payment schemes, particularly the MB scheme, MB WAY and other MULTIBANCO network payment services, were required to also contract the SIBS Group’s processing services, without the possibility of contracting access only to the payment schemes.

Besides the SIBS Group, there are alternative processors operating in Europe that could offer their services in Portugal and even some acquirers capable of processing their own transactions that were prevented from doing so in order to accept payments under the SIBS Group’s schemes.

The access to these payment schemes is necessary for an issuer to provide cards allowing payments under these brands to its clients (consumers).

Acquirers also need to access the MB scheme and MB WAY to enable merchants to accept these payments in physical stores.

In turn, card payments need to be processed. Processing services consist of executing the necessary actions for the processing of payment instructions between the acquirer and the issuer, ensuring authorisation, clearing and settlement of transactions.

On 28th July 2022, the AdC adopted the Statement of Objections (accusation) in the context of this case, subsequently providing SIBS Group with the opportunity to exercise its right to be heard and the rights of defence, which were duly considered in the final decision.

The practice at stake, known as tying, constitutes an abuse of a dominant position and represents a high degree of harm to competition, also harming consumers.

Since 2015, regulatory developments occurred in the payment services sector, both at the European and national levels, such as the Second Payment Services Directive and its transposition into national law in 2018, aimed at ensuring equivalent conditions for operators already in the market and new operators to exercise their activity, allowing the deployment of new payment methods based on digital technologies.

This process of digitisation of payment services offers new opportunities for competition in the sector to the benefit of consumers through more competitive prices, more choice, and services better tailored to their preferences.

The conduct investigated and now sanctioned by the AdC – which occurred between at least February 2019 and at least October 2021 – may hinder this evolution in the sector, restricting competition and innovation in the markets concerned.

The fine

The AdC fined the SIBS Group € 13,869,000 (thirteen million, eight hundred and sixty-nine thousand euros).

The fines imposed by the AdC are determined by the turnover of the companies in the affected markets during the years of the practice.

According to competition law, fines cannot exceed 10% of the turnover in the year prior to the adoption of the decision.

When setting the fine, the AdC takes into account the seriousness and duration of the infringement, the degree of participation of the companies involved in the infringement and their economic situation, among other circumstances (AdC Guidelines on the methodology to be used in imposing fines).

The AdC's sanctioning decisions may be subject to appeal. The appeal does not suspend the execution of the fines. Companies may request from the Competition, Regulation and Supervision Court to suspend the execution of the decisions if (i) they demonstrate that they cause them considerable harm and (ii) offer effective guarantees in their place.

It is important to highlight that the violation of competition rules not only reduces consumer welfare but also harms companies' competitiveness, penalising the economy.